Sustainability

-

01 Message

-

02 Initiatives

-

03 DX Value Co-creation

-

04 Talent・Team

-

05 Community

-

06 Corporate Governance

-

07 Environment

-

08 Factsheet

Corporate Governance

Enhancing Corporate Governance and Risk Management

Sun Asterisk Inc. (hereinafter "Sun*") regards the establishment and continued enhancement of a corporate governance system suitable to Sun*, which will serve as the foundation for Sun* to fulfill its corporate social responsibilities and conduct operations aiming to increase corporate value in the medium to long term, as an important management issue.

Sun* is committed to establishing an internal system that ensures prompt and rational decision-making as well as efficient business execution, and to enhancing corporate governance, in order for Sun* to pay respect to its stakeholders, increase soundness and transparency as a company, and aim for stable long-term appreciation of shareholder value. Sun* has implemented all of the principles stipulated in the "Corporate Governance Code" of the Tokyo Stock Exchange and provides details on the disclosure items required under each principle in Sun*'s Corporate Governance Report.

Corporate Governance System

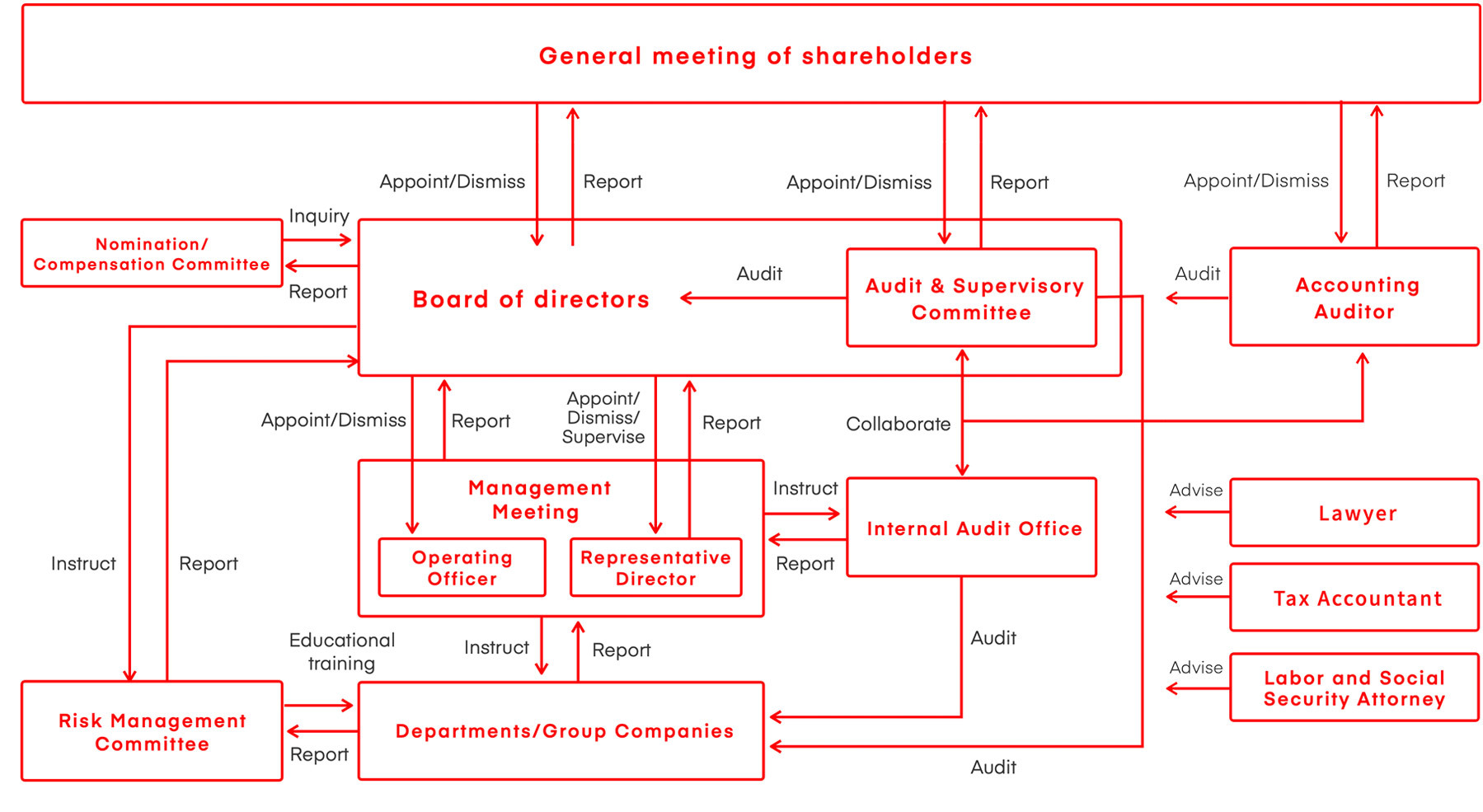

Sun* determined that a structure with an "audit and supervisory committee" (in which the majority of the members would consist of "audit and supervisory committee members" and outside directors with audit and supervising responsibilities as well as voting rights at board of directors meetings) would be effective for supervising of the Board of Directors and enhancing corporate governance. Accordingly, upon receiving approval on the necessary amendments to the articles of association at the 6th Ordinary General Meeting of Shareholders held on March 29, 2019, we converted to a "company with an Audit and Supervisory Committee" in order to further ensure the soundness and efficiency of our operations. Sun* organs include shareholders' meetings, Board of Directors, an Audit and Supervisory Committee and accounting auditor. In addition, Sun* also has a management council to expedite decision-making in business execution.

Sun* has not established an independent "nomination/compensation committee" as it is not mandatory. But on issues related to executive compensation and shareholders' meeting agenda items including director candidates, we explain and seek advice from independent outside directors and Audit and Supervisory Committee members prior to receiving a resolution from the board of directors. For this reason, we believe the independence and objectivity of functions and accountability of the Board of Directors are uncompromised.

Sun*'s Continued Efforts

- March 2019: Transition to company with Audit and Supervisory Committee, appointed two outside directors.

- October 2019: Completed report on reasons for appointing outside directors and their independency status.

- July 2020: Listed on the Tokyo Stock Exchange's Mothers market.

- March 2021: Appointed a female director.

- October 2021: Establishment of voluntary Nomination and Compensation Committee.

- Mar. 2022: Appointment of three outside directors and two female directors.

- Dec. 2022: Listed on the prime market of the Tokyo Stock Exchange (segment transfer).

Corporate Governance System

The Committee, consisting of three outside directors (Toshihiro Ozawa, Eriko Ishii, and Makiko Ishiwatari) and one director (Ken Nihonyanagi), is an advisory body to the Board of Directors and examines the nominations and compensation of directors.

Members of the Board of Directors and the Audit and Supervisory Committee and Their Experience/Expertise

| Name | Position | Attribution | Experience / Specialty | ||||||||

| Independence | Corporate CEO/Management Top |

Related Industry /Business |

IT/ Technology |

Marketing/ Sales |

Global Business | Personnel/ Human Resources Development |

Treasury /Accounting |

Risk management /Public relations |

|||

| Taihei Kobayashi | CEO | Male | ● | ● | ● | ● | ● | ● | |||

| Yusuke Hattori | Director | Male | ● | ● | ● | ● | ● | ● | |||

| Makoto Hirai | Director | Male | ● | ● | ● | ● | |||||

| Ken Nihonyanagi, Director |

Director Full-time Audit and Supervisory Committee member |

Male | ● | ● | ● | ||||||

| Toshihiro Ozawa | Outside director Audit and Supervisory Committee |

● | Male | ● | ● | ● | ● | ||||

| Eriko Ishii |

Outside director Audit and Supervisory Committee |

● | Female | ● | ● | ||||||

| Makiko Ishiwatari | Outside director | ● | Female | ● | ● | ● | ● | ||||

Basic Policy for Appointment of Directors

- Those with outstanding personalities and insight and respect for our management philosophy.

- Those with a deep understanding of Sun*'s history, corporate culture, employee characteristics, and sufficient business experience and knowledge.

- Those who, based on factors including our business environment and competition, can contribute to increasing corporate value, and are capable of developing and implementing business strategies and action plans to continuously improve corporate value over the medium to long term, and who, at all times, endeavor to verify outcomes and further improve on strategies and action plans.

- Those who are keyed into changes in the industry that our group belongs and the value of the services we provide, and who can constructively deliberate on the direction the group should take

Criteria for Selecting Director Candidates who are Not Audit and Supervisory Committee Members

Criteria for Selecting Director Candidates who are Audit and Supervisory Committee Members

- Those who have served Sun* as directors or executive officers, or who have had positions in management function departments or the internal audit department, etc.

- Lawyers or other legal experts

- Those with management experience

- Those with substantial expertise in accounting and finance

- Those with knowledge and experience in industries related to our business, such as IT and internet-related industries

- Those with profound experience in research and development

- Those with experience or capabilities equivalent to any of the above

Appointment Procedure

Reasons for Appointing Outside Directors and their Independency Status

Outside Director/Audit and Supervisory Committee Member

Independent officer: ○

Board of Directors Attendance: ○ (12/12)

Audit and Supervisory Committee Attendance: ○ (14/14)

( ) indicates previous year's attendance

Outside Director/Audit and Supervisory Committee Member

Independent officer: ○

Board of Directors Attendance: ○ (12/12)

Audit and Supervisory Committee Attendance: ○ (14/14)

( ) indicates previous year's attendance

Outside Director

Independent officer: ○

Board of Directors Attendance: ○ (9/9)

Audit and Supervisory Committee Attendance: ○ (-)

( ) indicates previous year's attendance

We expect her to provide advice and recommendations from a broad range of management perspectives, and therefore, we nominate her as an outside director.

The Company has designated Ms. Ishiwatari as an independent director and an outside director because she meets the criteria for independence as stipulated by the Tokyo Stock Exchange and there is no risk of a conflict of interest between her and general shareholders.

(Note) Ms. Makiko Ishiwatari's name in the family register is Makiko Murase.

1.Methods of Analysis and Evaluation

(1) The Company's Board of Directors has established the evaluation method and process through repeated discussions.

(2) Questionnaires were sent to all directors in service (including those who are members of the Audit and Supervisory Committee) and responses were obtained. The evaluation items were as follows: (a) Composition of the Board of Directors, (b) Agenda of the Board of Directors meetings, (c) Operation of the Board of Directors meetings, and (d) System to support the Board of Directors.

(3) Based on the responses to the questionnaire, the Board of Directors exchanged opinions and discussed future initiatives.

2. Summary of Analysis and Evaluation Results

The results of the questionnaire and discussions confirmed that the Board of Directors maintains a high level of effectiveness and that substantive discussions are held at Board meetings. In light of the role of the Company's Board of Directors, we judged that the Board of Directors as a whole, maintains a high level of effectiveness from the following perspectives:

- The Board of Directors has been engaging in constructive discussions by utilizing the experience and expertise of each director through adequate support for directors in cooperation with the Corporate Planning Department, Internal Audit Department, and other divisions.

- There is active discussion on improving group performance to enhance corporate value.

However, on the other hand, for the purpose of achieving the advancement of the effectiveness of the Board of Directors, and to continue to improve corporate value, the following items were identified as issues that need to be further addressed.

- Ongoing discussions on medium- and long-term management issues and plans.

- Operational improvements, including more detailed board meeting materials and improvements in the early sharing of documents.

- Provide directors with information on relevant laws and regulations, and offer and facilitate training opportunities.

Based on the results of the survey and discussion, all directors discussed the ideal governance of the group, and confirmed that the following items will be focused on in FY2024.

(1) Discussions on key agenda items, including medium- and long-term management strategies

(2) More detailed board meeting materials and improvements in the early sharing of these documents

(3) Enhanced support for board meetings by providing directors with information on relevant laws and regulations, as well as offering and facilitating training opportunities

By implementing the above initiatives, the Company will continue its efforts to improve the effectiveness of the Board of Directors and strengthen corporate governance.

Directors' Remuneration Policyy

① Fundamental Policy

Our basic policy is to establish a directors' remuneration structure that appropriately incentivizes directors to achieve continuous enhancement of corporate value while maintaining alignment with shareholders' interests, under which remuneration of each director is determined in accordance with their responsibilities. Remuneration of executive directors will consist of a fixed basic component, a performance-linked component, and non-monetary remuneration, while remuneration of directors with administrative responsibilities and outside directors will be limited to a basic remuneration in light of their responsibilities.

② Policy for Determining Basic Monetary Remuneration of Directors (Including policy to determine the relevant remuneration period and conditions)

Basic remuneration of directors will be a monthly fixed remuneration to be determined in line with the positions, responsibilities and years of tenure as a director and after overall assessment of remuneration levels of other companies, company performance and company employee wage level.

③ Policy for Determining Amount and Details of Performance-linked Remuneration and Non-monetary Remuneration(Including policy to determine the relevant remuneration period and conditions)

The performance-linked remuneration, etc. shall be a cash remuneration reflecting the results of the performance indicators (KPI) to raise awareness of the need to improve performance in each fiscal year, and shall be paid at a certain time each year as a bonus (pre-determined salary) in an amount predetermined in proportion to the percentage of achievement of the target consolidated operating profit for each fiscal year. At the Board of Directors meeting held on February 22, 2023, it was resolved that performance-linked remuneration for the 11th and subsequent fiscal years shall be a cash remuneration reflecting the results of the performance indicators (KPI) to raise awareness of the need to improve performance for each fiscal year, and that the amount calculated based on whether the target values of consolidated sales and consolidated EBITDA for each fiscal year are achieved or not shall be paid. The target value shall be the consolidated EBITDA calculated based on the "consolidated net sales" and "consolidated EBITDA forecast" stated in the financial statements for the previous fiscal year.

The target performance indicators and their values shall be set at the time of the plan's formulation and, from time to time, in response to changes in the environment, the Nomination and Compensation

The target performance indicators and their values shall be set when the plan is formulated, and shall be reviewed from time to time in light of the Nomination and Compensation Committee's report in response to changes in the environment.

As for non-monetary compensation, some kind of stock compensation plan shall be considered within five years after listing, and shall be introduced as appropriate, based on the report by the Nomination and Compensation Committee in response to changes in the business environment.

④ Policy on Determination of Allocation of Amounts between Monetary Remuneration, Performance-linked Remuneration and Non-monetary Remuneration for Directors.

Allocation for executive directors will be based on the policy that the portion of performance-linked remuneration will increase in line with the seniority of the director, using allocation ratios utilized by companies of size, industry and business type similar to Sun* as benchmarks for consideration of the Audit & Supervisory Committee. The Board of Directors (Representative Director entrusted with the authority under ⑤ below) must respect the recommendation given by the Audit and Supervisory Committee, and will determine the remuneration for each director within the recommended remuneration allocation band designated for each type.

The guideline allocation ratio for each type of remuneration for the time being shall be: basic remuneration 55-75%, performance-linked remuneration 25-45%, non-monetary remuneration 0%.

⑤ Determination of Remuneration of Each Director

Determination of actual amount of remuneration of each director shall be entrusted to the Representative Director by resolution of the Board of Directors. The scope of authority will be the allocation to each individual of the bonus based on the basic remuneration of each director and the performance of the business under that director's responsibility. In order to ensure proper execution of responsibility by the Representative Director, the Board of Directors shall present the Audit & Supervisory Committee with the draft proposal for their consideration and recommendation. The Representative Director entrusted with the authority must determine the final allocation in accordance with the Committee's recommendation. For non-monetary remuneration, the Board of Directors will establish details of the non-monetary remuneration of each director based on the recommendation of the Audit and Supervisory Committee.

Compensation, etc. by Officer Category

| Category | Total Remuneration, etc. (Million yen) |

Total Amount Per Type of Remuneration (Million yen) |

Number of Persons Receiving Payment | ||

| Basic Remuneration | Performance-linked remuneration, etc. | Non-monetary compensation, etc. | |||

| Director (Audit and Supervisory Committee members) (of which Outside Directors) | 77 (3) | 62 (3) | 15 (ー) | 0 | 5 (1) |

| Director (member of Audit & Supervisory Committee members) (of which Outside Directors) | 18 (9) | 18 (9) | 0 | 0 | 3 (2) |

| Total (of which Outside Directors) | 95 (13) | 80 (13) | 15 (ー) | 0 | 8 (3) |